A Biased View of Independent Investment Advisor Canada

A Biased View of Independent Investment Advisor Canada

Blog Article

The Of Ia Wealth Management

Table of ContentsThe 7-Minute Rule for Ia Wealth ManagementSome Known Details About Lighthouse Wealth Management How Lighthouse Wealth Management can Save You Time, Stress, and Money.Some Of Lighthouse Wealth ManagementGet This Report on Investment RepresentativeInvestment Consultant Things To Know Before You Get This

“If you were purchase a product or service, state a tv or a computer, you'll wish to know the requirements of itwhat are its components and just what it can perform,” Purda explains. “You can think about getting monetary guidance and help just as. Men And Women must know what they are getting.” With economic information, it's crucial that you just remember that , this product is not bonds, shares or any other investments.it is such things as cost management, planning for your retirement or reducing debt. And like getting some type of computer from a trusted business, customers would like to know these are generally buying monetary advice from a reliable pro. Certainly one of Purda and Ashworth’s best findings is just about the fees that economic coordinators charge their customers.

This conducted real no matter the cost structurehourly, percentage, assets under management or flat rate (inside research, the buck value of fees had been exactly the same in each instance). “It nevertheless boils down to the worth idea and doubt throughout the consumers’ part that they don’t know very well what they have been getting in trade of these costs,” claims Purda.

The Best Guide To Investment Representative

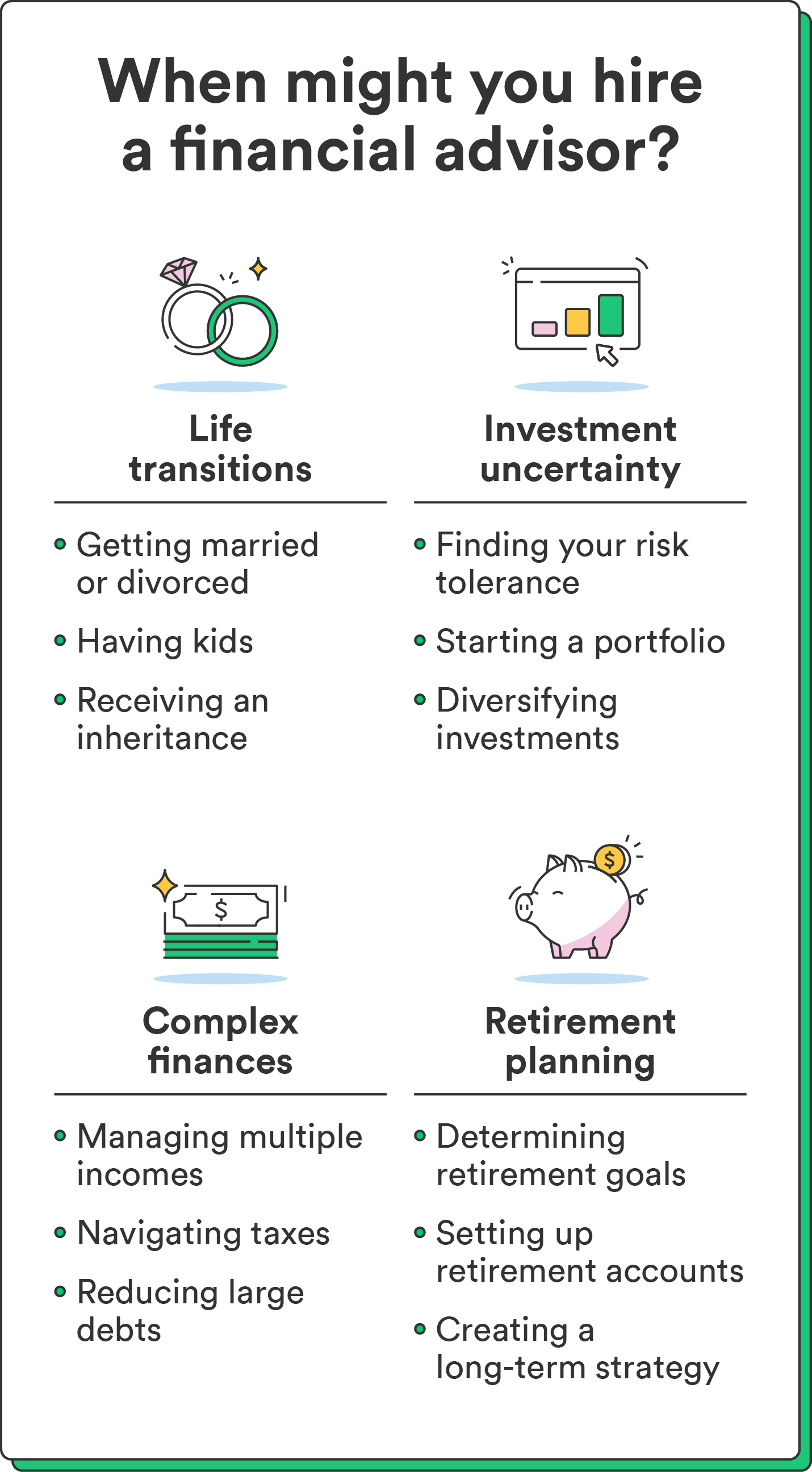

Pay attention to this article once you notice the definition of monetary advisor, exactly what one thinks of? Many people think about a specialized who are able to provide them with economic advice, especially when you are considering investing. That’s a good place to begin, however it doesn’t decorate the full picture. Not even close! Financial experts might help individuals with a bunch of various other cash goals also.

An economic advisor can help you create wide range and shield it for all the long haul. They are able to calculate your future monetary needs and plan methods to extend your own pension savings. They are able to additionally help you on when you should begin experiencing personal safety and ultizing the income inside pension records to avoid any horrible penalties.

Getting The Private Wealth Management Canada To Work

They are able to guide you to find out what shared resources are best for your needs and show you tips manage and come up with one particular of one's financial investments. They're able to also help you see the threats and what you’ll ought to do to quickly attain your goals. A practiced investment expert can also help you remain on the roller coaster of investingeven whenever your financial investments take a dive.

They could provide you with the advice you'll want to develop an idea so you're able to make fully sure your wishes are carried out. While can’t place a price tag on the reassurance that include that. In accordance with research Your Domain Name conducted recently, an average 65-year-old pair in 2022 requires about $315,000 saved to pay for medical care prices in pension.

Retirement Planning Canada for Beginners

Since we’ve reviewed exactly what economic experts would, let’s dig inside many types. Here’s an effective principle: All financial planners tend to be economic analysts, however all experts are planners - https://padlet.com/carlosprycev8x5j2/lighthouse-wealth-management-a-division-of-ia-private-wealth-nb61uqub0429yw8i. A financial planner focuses on helping individuals generate intentions to attain long-lasting goalsthings like beginning a college fund or preserving for a down cost on a property

How do you know which financial expert is right for you - https://www.4shared.com/u/kgVWRQiu/carlosprycev8x5j2.html? Check out actions you can take to make certain you are really hiring suitable person. What do you do when you have two terrible choices to select from? Effortless! Get A Hold Of a lot more solutions. The greater options you have, a lot more likely you may be to create an excellent decision

See This Report about Investment Representative

All of our Intelligent, Vestor system makes it easy for you by showing you as much as five economic experts who can serve you. The best part is, it’s free in order to get linked to an advisor! And don’t forget about to come to the interview ready with a list of concerns to inquire of so you can figure out if they’re a good fit.

But listen, simply because a consultant is wiser than the average keep does not provide them with the right to reveal how to proceed. Sometimes, advisors are loaded with by themselves simply because they do have more levels than a thermometer. If an advisor starts talking-down for your requirements, it is time for you demonstrate to them the door.

Remember that! It’s essential along with your financial advisor (the person who it ends up becoming) take equivalent page. You want a specialist who has got a long-term investing strategysomeone who’ll convince one keep trading consistently whether or not the market is upwards or down. ia wealth management. You don’t wish to deal with someone who forces you to buy something that’s also high-risk or you’re not comfortable with

The Ultimate Guide To Retirement Planning Canada

That mix will provide you with the diversity you ought to successfully invest for your longterm. Whenever study financial analysts, you’ll probably find the word fiduciary task. This all suggests is any specialist you hire has to work in a way that benefits their unique client rather than their self-interest.

Report this page